Unprecedented access to small business loan data

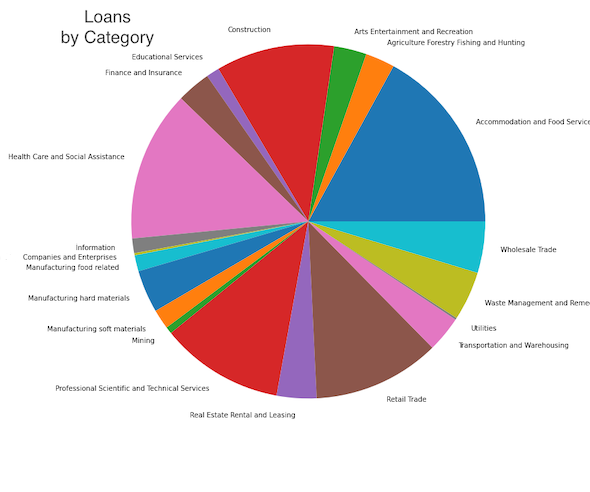

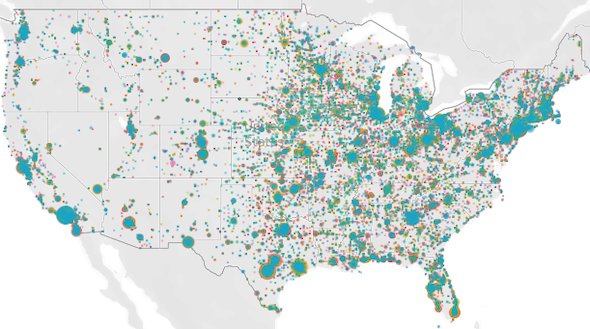

It seems that no section of the country was untouched by enterpreneurs seeking relief from the effects of the government shutdown in reaction to the Coronavirus. The release of lending records from the US Treasury in conjunction with the Small Business Association, albeit under unfortunate circumstances, allows an unusual glimpse into small businesses affected by the crisis.

This is not an analytical deep dive

The purpose of this project was to merge, wrangle and munge the data released by the SBA which was structured in a fairly useless way when it comes to analyzing the entire United States. There are over 50 related CSV files tucked away in folders for individual states. These files needed to be joined to one another in order to see the country as a whole. What would normally be an arduous process to do by hand I was able to do in minutes with programming. This resulted in a dataset of almost 5 million records, which not only needed refinement but could not be opened with Excel or Google Sheets, and so I continued the process using Python and SQL. That being said, some level of analysis is a component of any data pipeline project and what is displayed on this page and in the visualizations linked in the navigation menu are a byproduct of this light analysis. I decided to share it here because I think it is interesting, and I hope you do too. I will be continuing the statistical journy as time permits. My normalization process and github repository is accessible via the "DATA PIPELINE" link.

A note about the visualizations

The visualizatons are best viewed on a computer. They are hosted courtesy of Tableau Public which make interactivity and hosting easy but load times are influenced by the user's connection speed and the amount of data being pushed to the page. Read the paragraph at the bottom of each illustration page for further instruction on how to prevent the "spinning wheel" of a frozen web page.

Initial analysis

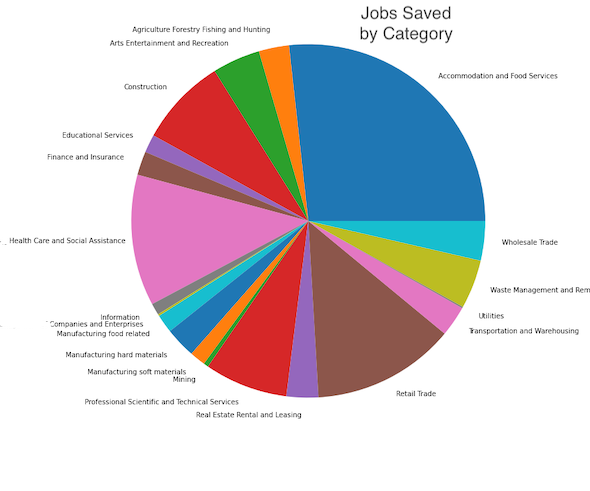

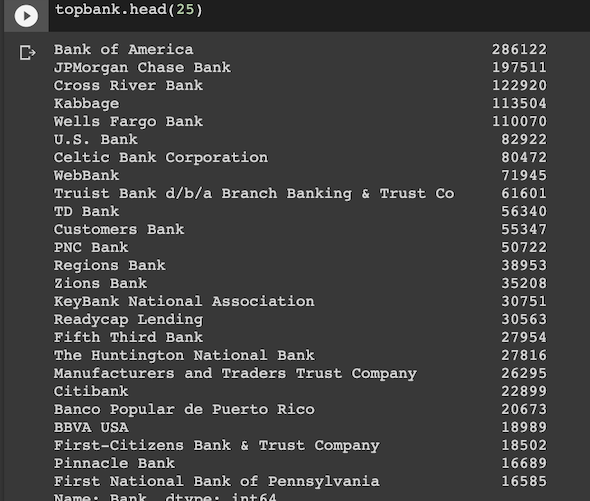

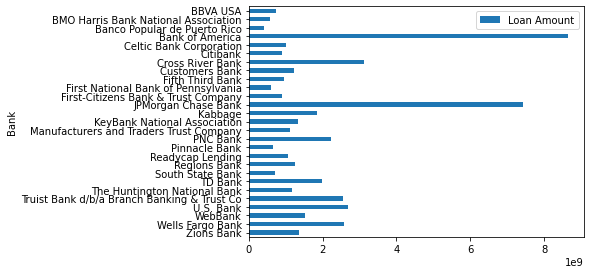

The purpose of the loans was to help businesses save jobs. The potential expenditure per capita of funds for the larger loan amounts came in at $2,000 and the under $150k disbursements at $8,000 per job saved. This assessment is based on calculations infered from statements Steve Mnuchin made, namely that the sum of the loans over $150k account for 75% of the total lent and was borrowed by only 13% of enterprises.

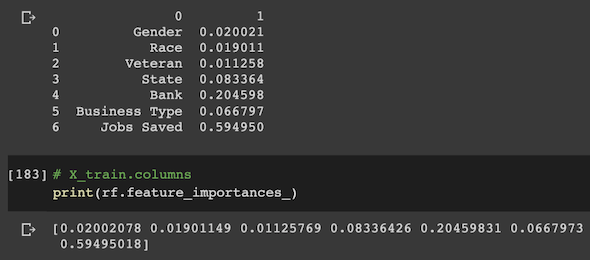

Machine learning also suggested a dependency between number of jobs "saved" and loan amounts as it gave this feature the most weight.

Even though the largest of loans seemingly went to the biggest employers, a question arises as to how effective $2000 per job would be in helping employees in comparison to the smaller business loans which had a higher amount of money per person ratio.